Table of Contents

- Indonesia’s 2025 Budget and Economic Outlook - ISEAS-Yusof Ishak Institute

- Inflasi Awal Tahun 2023 Capai 5,28 Persen - Mediasuarapublik.com

- Global Inflation Rates in 2025: What to Expect

- Inflation 2025 En Europe - Maddox Bamboo

- Inflation only seen hitting target in 2025 | The Manila Times

- Stronger inflation in 2025 on analysts’ radar | Economy ...

- Inflation Relief Program October 2025 Ny - Cameron Baker

- Inflation target becomes continuous from 2025, decides CMN | Take Investing

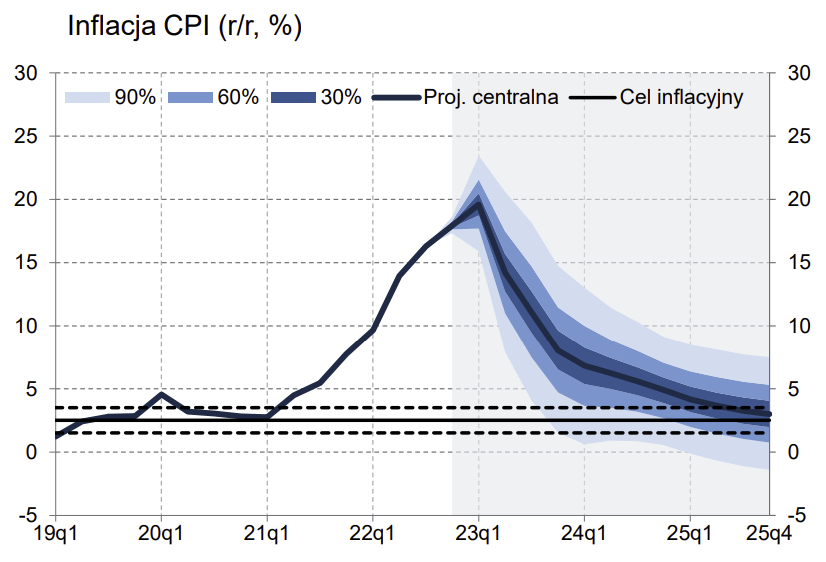

- Prognoza inflacji od NBP do 2025 r. Czy Bitcoin pokona złotego?

- Current Inflation Rate 2025 Usa By Year - Dalia Yalanuna

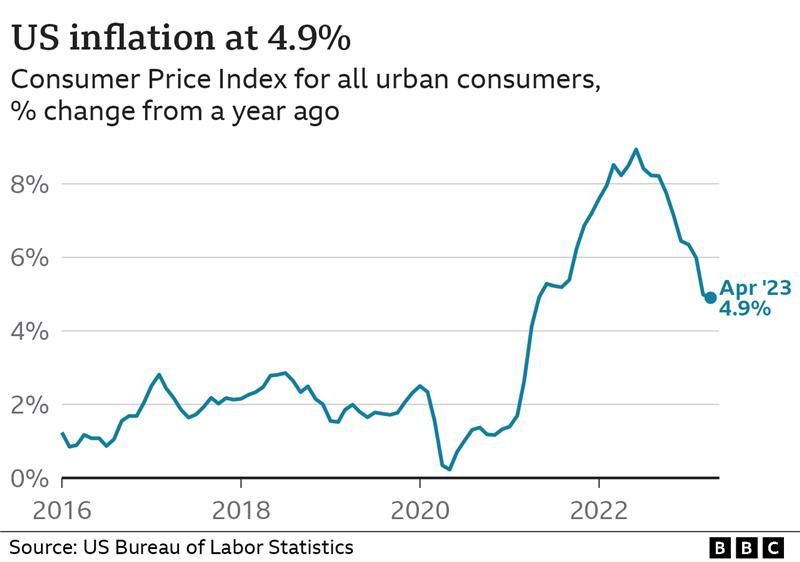

The United States has experienced a rollercoaster of economic fluctuations over the past few decades, with inflation being a key indicator of the country's financial health. Inflation, which is the rate at which prices for goods and services are rising, has been a topic of interest for economists, policymakers, and the general public alike. In this article, we will delve into the current US inflation rates from 2000 to 2025, analyzing the trends, causes, and implications of these rates on the economy.

Historical Context: Inflation Rates from 2000 to 2020

:strip_icc()/i.s3.glbimg.com/v1/AUTH_37554604729d4b2f9f3eb9ad8a691345/internal_photos/bs/2024/a/H/zPfuo6QCCtEj8I2dACWQ/110522bassoli11.jpg)

According to the Bureau of Labor Statistics (BLS), the US inflation rate has fluctuated significantly over the past two decades. In the year 2000, the inflation rate was 3.4%, which was relatively high compared to the preceding years. The rate then decreased to 2.8% in 2001 and continued to decline to 1.6% in 2002. The period between 2003 and 2007 saw a steady increase in inflation, with rates ranging from 2.3% to 3.2%.

The 2008 financial crisis led to a significant decline in inflation, with the rate dropping to -0.4% in 2009. However, as the economy recovered, inflation began to rise, reaching 3.2% in 2011. The subsequent years saw a decline in inflation, with rates ranging from 1.5% to 2.1% between 2012 and 2019.

Current Inflation Rates: 2020-2025

The COVID-19 pandemic had a profound impact on the global economy, leading to a significant increase in inflation. In 2020, the US inflation rate was 1.2%, which rose to 4.7% in 2021. The current inflation rate, as of 2022, is 6.5%, which is the highest it has been in over a decade.

Looking ahead to 2025, economists predict that the inflation rate will continue to rise, albeit at a slower pace. The projected inflation rate for 2023 is 4.2%, 3.5% for 2024, and 3.2% for 2025. These projections are based on the assumption that the economy will continue to grow, albeit at a moderate pace, and that the Federal Reserve will maintain its current monetary policy stance.

Causes and Implications of Current Inflation Rates

The current high inflation rates can be attributed to a combination of factors, including the COVID-19 pandemic, supply chain disruptions, and an increase in demand for goods and services. The pandemic led to a significant increase in government spending, which injected a large amount of money into the economy, leading to higher demand and prices.

The implications of high inflation rates are far-reaching. For consumers, high inflation means that the purchasing power of their money decreases, leading to a decrease in the standard of living. For businesses, high inflation can lead to increased costs and reduced profit margins. The high inflation rate also has significant implications for monetary policy, as the Federal Reserve may need to increase interest rates to combat inflation, which can lead to slower economic growth.

In conclusion, the current US inflation rates from 2000 to 2025 have been marked by significant fluctuations, with the rate increasing in recent years due to the COVID-19 pandemic and supply chain disruptions. Understanding the trends and causes of inflation is crucial for making informed decisions about monetary policy and economic planning. As the economy continues to evolve, it is essential to monitor inflation rates closely and adjust policies accordingly to maintain a stable and growing economy.

For more information on US inflation rates and economic trends, visit the Bureau of Labor Statistics website. Stay up-to-date with the latest economic news and analysis by following reputable sources such as CNBC and Bloomberg.