Table of Contents

- When Tax Return 2025 - Nina Brooke

- Gift Tax Deduction 2025 - Edee Kettie

- 2025 Small Business Tax Deductions Checklist - Blog - Akaunting

- When Will The Irs Accept Returns In 2025 - Ben T Schmidt

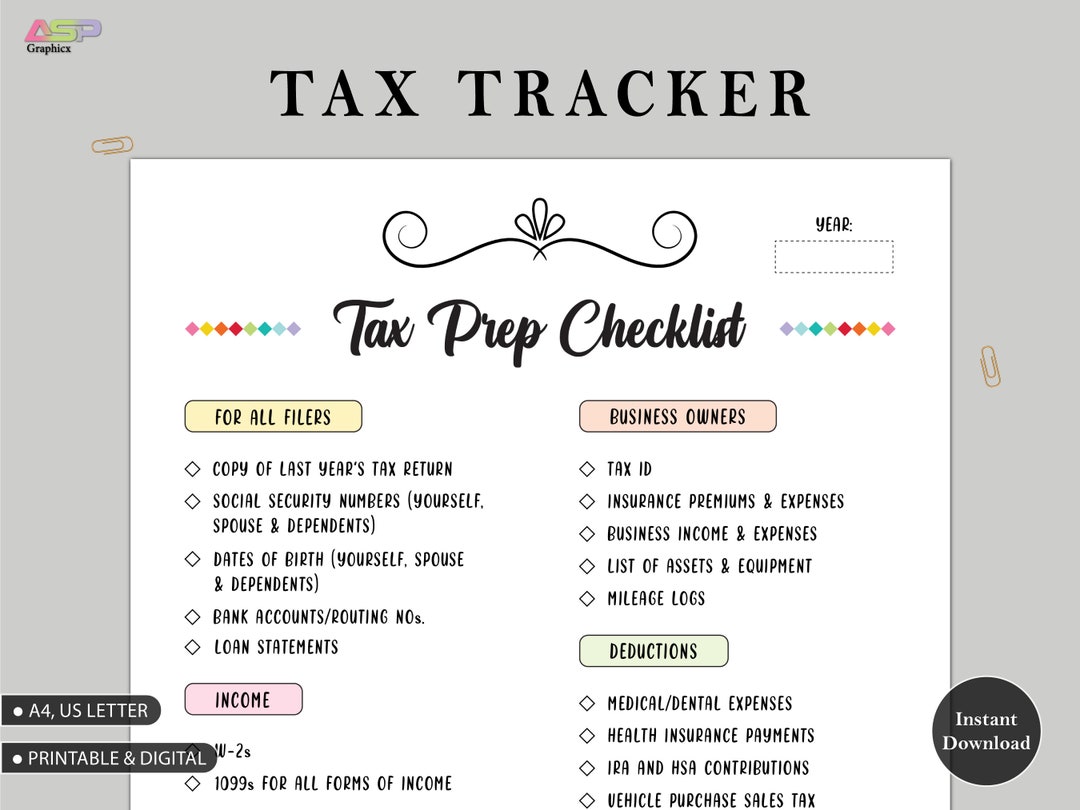

- Tax Prep Checklist Tracker Printable | Tax Prep 2023 | Tax Tracker ...

- 2025 Estate Tax Exemption | Mariner

- Tax Preparation - Livable Solutions

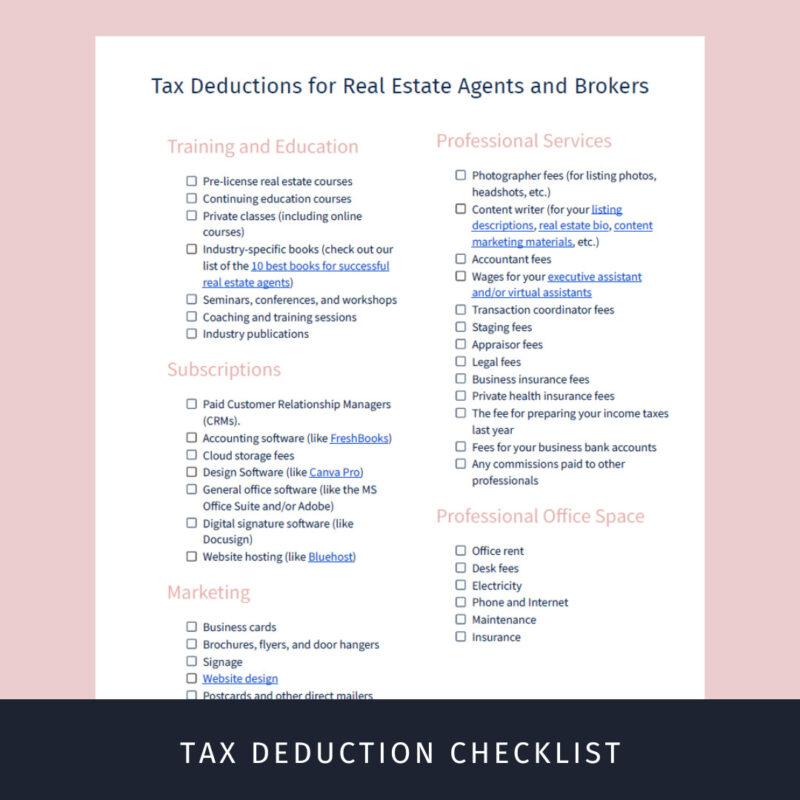

- Key 2021 tax deadlines & check list for real estate investors - Stessa ...

- Tax Form Checklist 2023 - Printable Forms Free Online

- Tax Deadline 2024 Extension Form 2024 - Meade Jocelyn

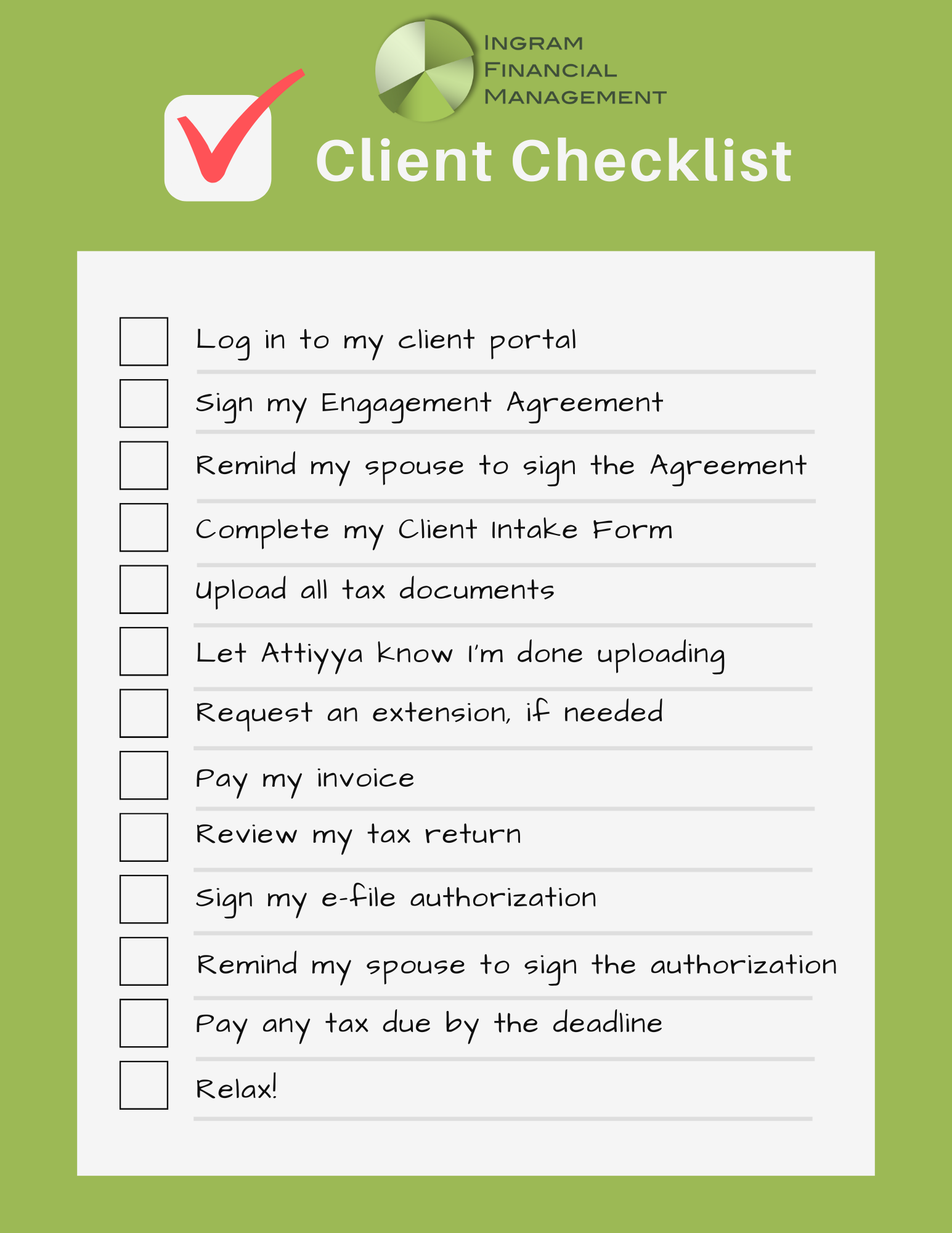

Gather Essential Documents

- W-2 forms: Collect W-2 forms from your employer, showing your income and taxes withheld.

- 1099 forms: If you're self-employed or have freelance income, collect 1099 forms from clients and contractors.

- Interest statements: Gather interest statements from banks, investments, and other financial institutions.

- Dividend statements: Collect dividend statements from investments and stocks.

- Charitable donation receipts: Keep receipts for charitable donations, including cash, goods, and services.

- Medical expense receipts: Collect receipts for medical expenses, including doctor visits, prescriptions, and hospital stays.

Maximize Your Deductions

- Mortgage interest: Deduct mortgage interest payments on your primary residence and second home.

- Property taxes: Deduct property taxes on your primary residence and other real estate investments.

- Retirement contributions: Contribute to retirement accounts, such as 401(k) or IRA, to reduce your taxable income.

- Education expenses: Deduct education expenses, including tuition, fees, and student loan interest.

- Child care credits: Claim child care credits for qualified child care expenses.

Meet Important Deadlines

Mark your calendar with the following important tax deadlines:- January 31, 2025: Receive W-2 and 1099 forms from employers and clients.

- April 15, 2025: File your tax return and pay any taxes due.

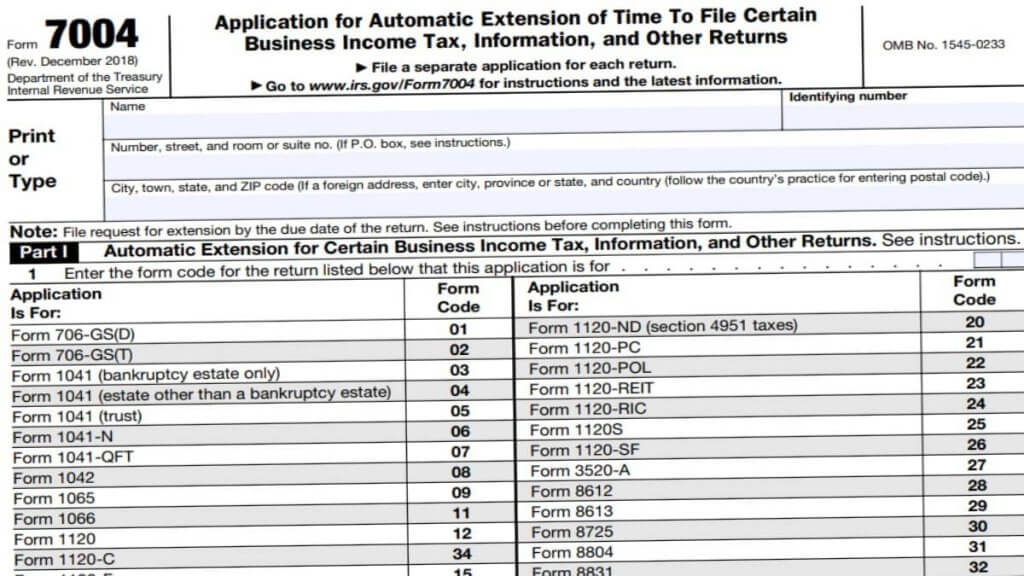

- October 15, 2025: File for an automatic six-month extension, if needed.

Keyword density: tax preparation checklist (1.2%), tax season (0.8%), deductions (0.6%), deadlines (0.5%)

Note: The keyword density is an estimate and may vary based on the actual content and length of the article. It's essential to optimize the article with relevant keywords to improve search engine ranking and visibility.